Welcome to the Pennsylvania Municipal Retirement System

The Pennsylvania Municipal Retirement System seeks to help Pennsylvania’s local governments, regardless of size or resources, secure the future retirement of their employees by providing comprehensive, cost efficient and professional pension administration services through a pension plan tailored to the participants’ and sponsor’s requirements.

Featured Content

- Agenda for Board of Trustees meeting

- Executive Update

- 2022 Schedule of Changes in Fiduciary Net Position by Participating Municipality

- 2022 Annual Comprehensive Financial Report

Upcoming Events

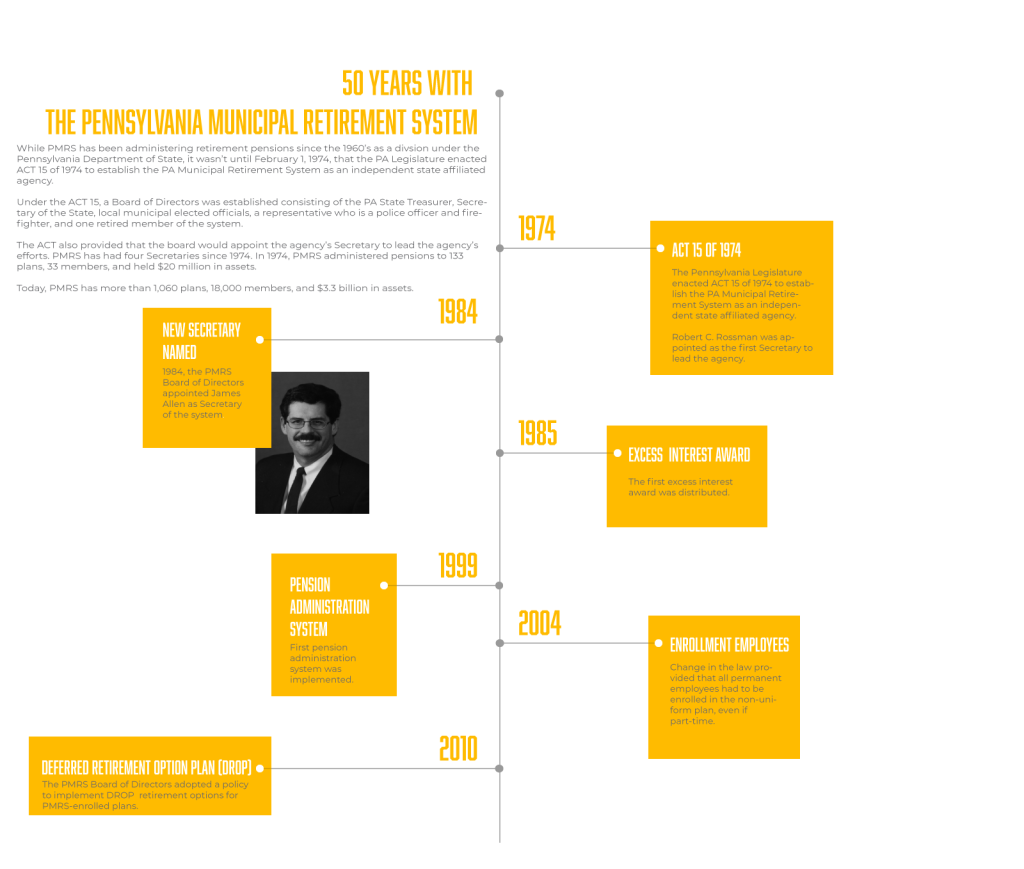

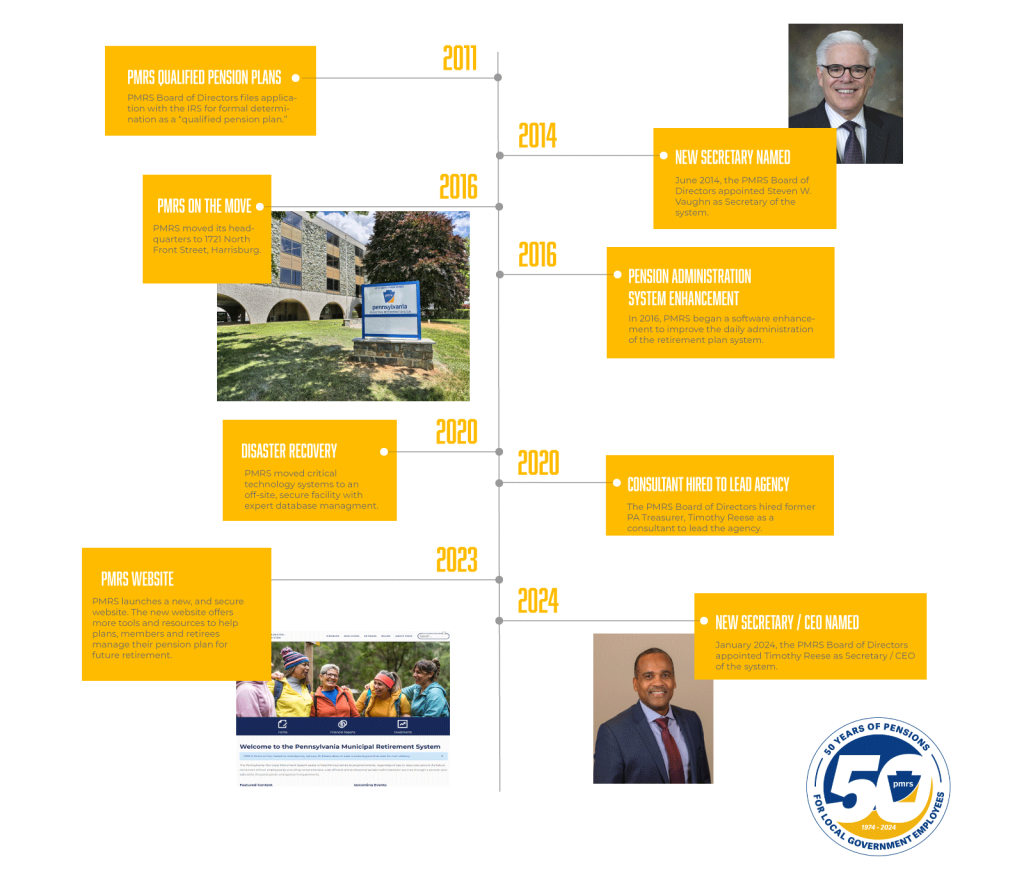

PMRS is 50! Help us celebrate 50 years of being Pennsylvania’s local government pension administrator of choice! We would like to highlight PMRS’ success stories throughout the year, and we’d love to hear from you! Share your story with us by clicking here on Share My Story.

PA Municipal Retirement System 1974 -2024